All-IN-ONE FINANCE TOOL

We offer instant payments tools for small businesses → and we charge ₹0.20 per transaction.

Invoice sent to

Vikram Singh

Trusted by 5K+ Companies

Do you know how much you pay to get your own money?

Most small businesses are either ignored or overcharged by big banks or card payment companies. The banks get a cut from sales, and in time, the amount of fees paid grows huge as businesses grow.

When there are no alternatives, the available practice becomes the standard like card payments and no one asks the question why anymore. Many business owners don’t realize how much money they’re losing on card processing fees since these fees are automatically deducted and not paid directly. Before they realize, they end up paying banks a lot more than they think.

We all know that, as a small business owner, your resources are limited. And cash is the single most critical resource you have to run your business.

This is why at Payfac, we focus on helping you get 100% of your money and get it instantly.

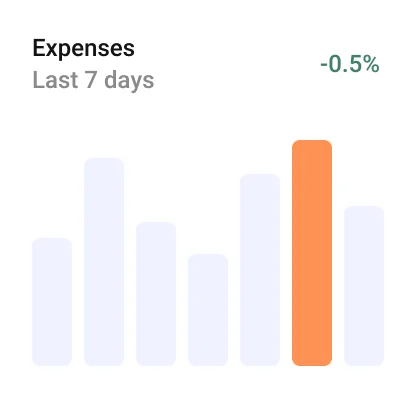

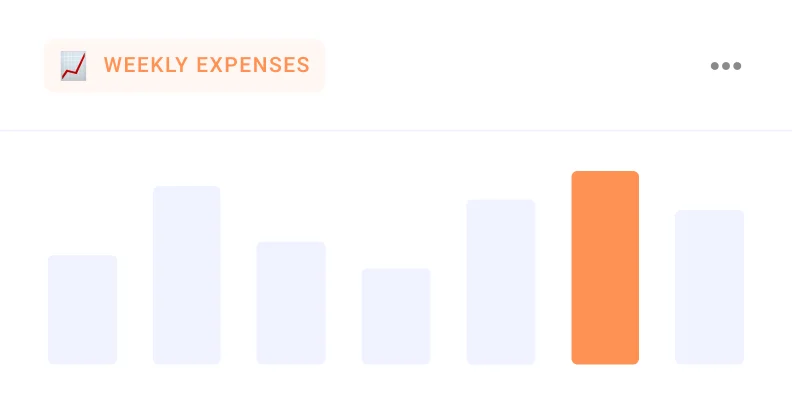

Why should you try the app?

Claim 10 free transactions

No commitments

No hardware needed

All you need is a bank account

Start with "Pay as you go"

No hidden fees

We care about transparency. At Payfac we like making things clear. You see what you’re going to pay and you pay it with no surprises. That’s all.

Built for people like you.

We know how it feels like to take a risk and make an investment. We feel the frustration you have when you have to find a way to sell more of what you create. And we also know how hard it is to make that sale.

That’s why we believe that when you do that sale, you should get all your money and you should get it immediately. And that’s also why we work hard to eliminate the fees you pay to get paid and the time you wait to receive your own money.

Find out why our customers love working with us

When we started using PayFac, most of my customers were using debit cards to pay for their purchases. That means they were actually using the money in their bank account to pay us. PayFac helped do the same but without paying anything to the card companies. Since then we’re trying to avoid card payments.

Satish

Brand Communications

Average transaction value for our store is around ₹450. After we met with PayFac, in the first month , we processed around 20 transactions just to give it a try and we managed to avoid paying ₹170 for card processing fees. It is still hard to believe that we just paid ₹4 instead.

SS Murthy

7 Star Enterprises

The main reason that I use PayFac is that I get my money in 10 seconds. I don’t have to wait for a payout or wait a week to receive my money. It totally changed our cash flow.

Manjunath

One9

Get Started in 3 Easy Steps

Create an account

Connect your bank account

Start using Payfac

Download Payfac app and login with your credentials and start charging customers with 10 free transaction credits on us

If you’re using Payfac integrations, then just login to your dashboard and start charging.

Get 10 free transaction credits

How to run your business without losing an arm to banks

At Payfac, we love working with entrepreneurs, risk takers, creators, designers who can still take the challenge of running a business against all odds. And for that, we know that you need solutions that are as new and bold as your approach.

The problem is that every payment corporation that you work with so far wants a cut from your sales which makes you feel frustrated since you have no other choice. Thanks to Open Banking, this is not your only option anymore.

We believe that no business should give away a cut from their revenues just to be able to get paid. We know how hard it is to do that sale and earn that money. That’s why we offer account-to-account payments with Open Banking where you pay only £0.20 per transaction. No card processing fees, no commitments, no chargeback, no hidden fees, no initial investment.

Here’s how it works.

1. Create an account in Payfac in 2 minutes.

2. Connect the bank account that you want to receive your money.

3. Download the Payfac app and start charging your customers.

Now, go ahead and create an account, so you can stop paying card fees, start getting your money instantly without waiting for payouts, and use your savings for something else to make your business thrive.

Create an account now

How do customers pay?

Scan Code

Choose Bank

Authorise Payment

Super Simple Pricing

₹0.20 per transaction

Top Up

₹20,000

Get 100K transactions

Standard E-mail support

Top Up

₹100,000

Get 500K transactions

Email and chat support on Whatsapp

Need something else?

Frequently Asked Questions

Open Banking is a term used to describe the process of banks and other financial institutions opening up data for regulated providers to access, use and share.

So what does it all mean?

- For businesses – More effective and efficient financial tools in your business, especially in payments. Which will mean things like freeing up more time and saving you money.

- For customers – Open banking will mean better ways to spend, borrow, and invest.

It simply means better payments solutions for businesses. Businesses could use payment products that improve cash flow, lower costs, increase visibility and control, and reduce fraud.

It also brings better borrowing terms. If you don’t have much credit history, you could end of not being able to qualify getting favourable borrowing terms. But with open banking, your historical bank account data can be accessed by lenders to help better demonstrate your creditworthiness.

While using our services, you have the full control of our relationship. We are always there for you but there are no commitments on your side. That means there are no monthly regular charges or fees. You pay as you use the services and you can stop anytime.

No they don’t.

For instant bank payments, they can simply scan the QR code and pay by using their own internet banking app without needing to download anything.

Unfortunately, Instant bank payments are available only in the UK for now. We’ll be rolling out in more European countries in the second half of 2022.

If you have a smart phone, the answer is no. That means you don’t need to buy another device, card reader, POS terminal and your smart phone will be enough to accept payments. We assume that your smart phone is able to support the late iOS or Android updates, that’s the only requirement.

We activate accounts on a daily basis. Once you submit your details, we usually get back to you within couple of hours. After that, it is on you to connect your account and start using PayFac.

With instant bank payments, you get 100% of the payment amount and you get it immediately. There is simply no waiting time for any payouts since the transactions settle on a real time basis and the payment amount arrives to your bank account instantly.

With card payments, it is also up to you to choose within your Stripe account how often you want to have the payouts. It can be daily, weekly or monthly depending on your preference.

It is bank grade secure. By using on-device authentication to confirm payments, biometrics and the banking app’s own security tools, the risk of fraud is dramatically reduced compared to card payments.

Yes, we wanted to leave this choice to the business owners instead of your customers. They can still ask for another option but mainly it is you who will choose in between instant bank payments and card payments.

Yes. We partner with Stripe and handle all card payments with them. You need to create a Stripe account first, and after that you can connect your Stripe account and start accepting card payments with your phone as well.

Currently “Tap card to pay” function works on all Android based smart phones that have an NFC chip. Unfortunately, Apple does not support 3rd party NFC payments therefore it does not work on iPhones.

Download Payfac App

In case your customers still want to pay by card

With Payfac app, your phone becomes a POS terminal

- Tap card to phone (Android)

- Scan to pay (iOS & Android)

- Apple Pay, Google Pay, Mastercard, Visa, Amex and many more...

- Accept cards from 135 countries and 35+ currencies

- Choose payout frequency

- Connect your Stripe account

No coding, no API required.

Built on Stripe

Zero cost to try, so much to experience.

Super easy set up

Your customers don't need to install a new app to pay you

You have total control over your payment costs.

Contact Us

PayFac Financial Technology Private Limited

(CIN) U74999KA2021PTC150271

175 & 176, Bilekally, BG Dollors Colony, Bangalore KA 560078, Karnataka, India